Defastra AI Agent Integration for Teams

AI agents let teams query Defastra for email or phone fraud risk scores in real time within team chat, enabling rapid decision-making. Enhance your Defastra workflows with AI-powered automation in Slack, Teams, and Discord.

Modern fraud detection requires teams to respond quickly, collaborate effectively, and make decisions based on up-to-the-minute intelligence. Defastra leads the way in OSINT-powered fraud analytics, but even the best tools are limited if they're stuck behind dashboards. Pairing Defastra with Runbear’s AI agent platform revolutionizes the game—by delivering risk scores, enrichment data, and actionable insights directly into your team’s Slack, Teams, or Discord workspace. Your entire team can access, summarize, and act on Defastra data instantly, with the AI agent working as a tireless analyst and facilitator in every conversation.

About Defastra

Defastra is an advanced OSINT fraud detection and risk analysis platform designed for organizations facing threats from digital fraud, synthetic identities, and complex attacks. Its core features—Deep Email Check, Deep Phone Check, advanced risk scoring, and enrichment from public and breach data—enable teams in finance, fintech, e-commerce, and security to quickly assess and triage suspicious contacts. Trusted by security operations and compliance teams, Defastra’s market position is centered on data completeness, depth, and continuously updated risk analytics. Companies adopt it to power onboarding decisions, payment protection, and customer verification workflows, ensuring they minimize risk and comply with regulatory frameworks without slowing down business operations.

By integrating OSINT data points and continuously evolving detection logic, Defastra is a fundamental tool for digital businesses committed to security and trust.

Use Cases in Practice

Bringing Defastra into team chat with Runbear unlocks new levels of automation, accessibility, and intelligence—right where work happens. Instead of relying on a single analyst to run fraud checks or compile reports, now every team member can trigger Defastra lookups or request explanations with a natural language prompt. Suppose sales receives a suspicious lead; just ask the AI agent in Slack: 'Check risk for john.doe@email.com.' Instantly, risk scores and OSINT-enriched profiles appear, ready for team review. Or, for compliance teams busy navigating ever-changing KYC and AML requirements, set up the AI agent to deliver weekly summaries of high-risk contacts analyzed by Defastra, complete with Slack-native charts showing trends. Streamline Q&A around risk analysis by having all Defastra guides and decision matrices synced as agent knowledge, letting anyone ask, 'What makes an email extreme risk?' and get an instant, up-to-date answer. Finally, for case investigation or escalation, a team member can ask the AI agent for a full enrichment report—retrieving breach, social, and risk context—from Defastra, without context-switching. The AI-Powered Executive Dashboard and How to Automate KPI Reporting showcase similar automation patterns that teams have already adopted to surface insights and cut manual effort.

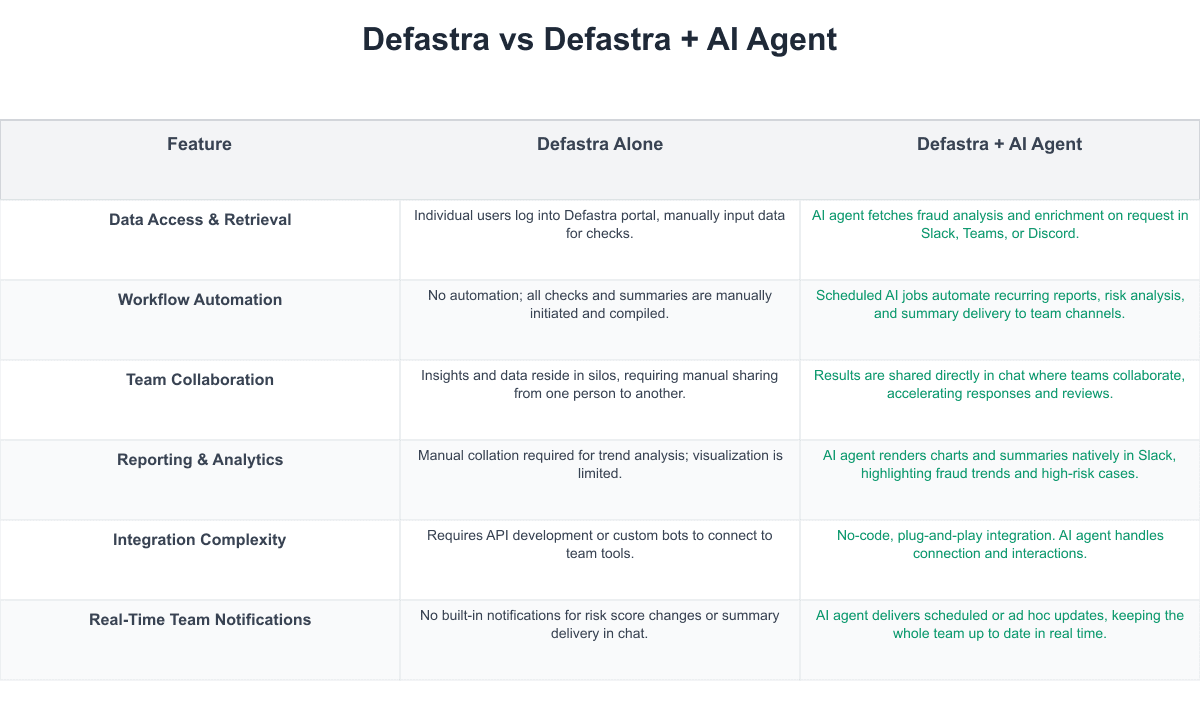

Defastra vs Defastra + AI Agent: Key Differences

Integrating Defastra with Runbear transforms manual, isolated fraud checks into collaborative, AI-powered workflows inside your team's chat tool. Instead of switching between disparate dashboards, team members access risk scores, compliance insights, and enriched fraud data instantly. This not only boosts productivity but ensures the whole team stays aligned and responsive, thanks to seamless AI agent automation.

Here’s how daily workflows change with Runbear+Defastra:

Implementation Considerations

Adopting an integrated Defastra-Runbear workflow requires teams to prepare for both opportunity and change. Initial setup demands granting appropriate permissions between Runbear, the team’s chat tool, and Defastra—with clear attention to data access and security best practices. Teams should ensure Runbear’s AI agent has access to necessary Defastra endpoints and any synced documentation for effective Q&A. Training is crucial: employees must be guided on new workflows, how to interact with the AI agent, interpret risk scores, and spot escalation triggers. There's also organizational change management: moving from siloed dashboards to chat-based, shared analysis needs buy-in across fraud, compliance, and sales departments. Cost-benefit analysis should include time saved on report preparation, faster responses, and fewer missed warning signs. Finally, changes to data governance and audit policies may be needed to record and review team decisions driven by chat-based analysis. Prepare additional security controls for sensitive risk data, and ensure regular audits of agent actions and access logs.

Get Started Today

Integrating Defastra with Runbear is a leap forward for teams fighting digital fraud. By embedding OSINT-powered fraud analysis directly into collaborative channels, every team member becomes empowered to query, investigate, and share critical data—in seconds, not hours. While some setup and training investment is required, the rewards include faster decisions, stronger compliance, and a smarter, more aligned team. Ready to see how an AI agent can transform your Defastra workflow? Try Runbear today and put actionable fraud insights at the heart of your team’s collaboration space.