<UseCaseSection sectionTitle="Key Use Cases for Moneybird & AI Agent Integration" useCases={[

{ title: "Instant Invoice Summaries in Slack", description: "AI agents deliver daily or weekly Moneybird invoice reports as charts in your team chat, keeping everyone updated effortlessly." },

{ title: "On-Demand Financial Queries", description: "Ask your AI agent about Moneybird data—like overdue invoices, monthly revenue, or expense trends—right in Slack and get instant answers." },

{ title: "Automated Expense Insights", description: "Schedule AI agents to analyze Moneybird expenses, summarize changes, and highlight unusual spend patterns for the team." },

{ title: "Collaborative Receipt Upload Reminders", description: "AI agents remind team members in Slack to submit receipts, improving Moneybird data completeness and expense tracking consistency." }

]} />

<GetStartedBanner title="Automate Your Moneybird Workflows with AI" description="Start your free trial and see the difference in minutes." />

Moneybird is widely used for streamlining small business accounting, but managing finances isn’t just about the numbers—it’s about keeping everyone in sync, informed, and ready to act. By integrating Moneybird with a smart AI agent using Runbear, your team transforms routine finance chores into seamless, chat-driven collaboration. AI-powered automation means reporting, analysis, and financial teamwork can all happen right where your conversations do—saving time, cutting errors, and keeping your team focused.

## About Moneybird

<IFrame url="https://www.youtube.com/embed/5JSe2bw4WEI" title="Moneybird CEO "I was building my million dollar business ..."" width="100%" height="315" />

Moneybird is a cloud-based accounting software tailored for small businesses and freelancers, mainly in the Netherlands and Belgium. It offers intuitive invoicing, expense tracking, VAT compliance, bank integration, and financial reporting—all designed to help entrepreneurs and growing teams automate tedious bookkeeping. With recent expansions including embedded banking features via Adyen, Moneybird enables users to manage both their books and cash flow from one modern platform. Teams adopt Moneybird because of its ease of use, localized compliance, and robust suite of finance tools designed for efficiency and scale without accounting expertise required. Whether managing invoices, syncing bank activity, or preparing taxes, Moneybird empowers businesses to stay on top of financial operations effortlessly.

## Use Cases in Practice

Let’s explore how Runbear’s AI agent makes Moneybird smarter and truly team-centric. Imagine your AI agent fetching the latest invoice totals before your Monday meeting, posting visual expense charts in Slack, or answering finance questions on demand. Scheduled jobs, smart reminders, and data analysis features empower finance teams, project managers, and business owners alike. For instance, Runbear can automate daily digest routines as documented in our [Slack daily digest guide](how-to-build-a-slack-daily-digest-you-can-chat-with), or help teams stay aligned with KPI reporting as shown in [Automate KPI Reporting](how-to-automate-kpi-reporting). This means everyone—from your accountant to your sales reps—has access to up-to-date Moneybird insights, right in your chat channels. The end result? Less manual pulling of reports, fewer missed receipts, and more collaborative team decision-making, powered by an AI agent that understands both your workflow and your Moneybird data.

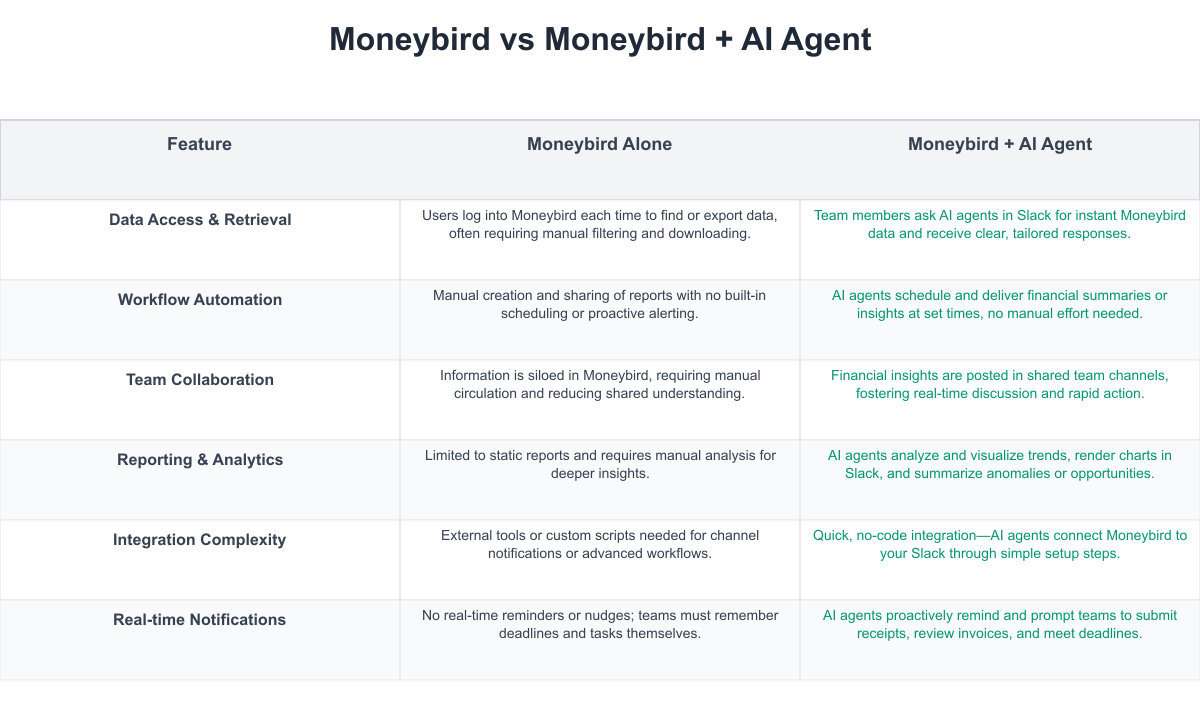

## Moneybird vs Moneybird + AI Agent: Key Differences

Integrating Moneybird with Runbear’s AI agent transforms your team’s manual and fragmented financial workflows into streamlined, automated processes right inside your communication hub. Instead of tackling repetitive reporting and endless searching, teams can leverage AI-powered automation, collaborative insights, and instant access to Moneybird data, all without switching apps. See how this evolution impacts real-world collaboration and decision-making:

## Implementation Considerations

Adopting Moneybird for team-wide finance management involves several challenges: ensuring all team members are trained and adopt new workflows, setting up correct user permissions and access, and maintaining data accuracy through regular receipt uploads and reconciliations. Integrating Moneybird with Runbear’s AI agent helps address these hurdles by automating reminders, simplifying data access, and reducing the team's manual workload. Teams should prepare for initial setup time, plan for structured channel usage in Slack or Teams, and clarify who leads finance-related communications. Additionally, consider data governance—define who can query sensitive Moneybird data via the AI agent—and evaluate cost-benefit by weighing time saved on manual reporting and increased team productivity. Investing in brief training and internal communication ensures the organization is ready to benefit from this next-gen integration.

## Get Started Today

Moneybird is powerful on its own—but when enhanced with a Runbear AI agent, it becomes the core of a collaborative, automated finance workflow. Your team gains instant access to insights, scheduled updates, and strong reminders, all right within your favorite chat tool. Start by integrating Runbear with Moneybird and unlock a smarter, faster way to manage your business finances. Ready for AI-powered teamwork? Connect Runbear with Moneybird today and help your team work smarter—not harder—with every invoice, expense, and report.

<GetStartedButton />