Build MaxMind minFraud workflows with AI Agents

AI agent gathers MaxMind minFraud data and posts easy-to-read fraud summaries to your team channels on schedule. Enhance your MaxMind minFraud workflows with AI-powered automation in Slack, Teams, and Discord.

Fraud prevention is a top priority for online businesses—and MaxMind minFraud is a leading solution for evaluating transaction risk. But what if you could put this powerful fraud intelligence directly into your team conversations? That’s exactly what happens when you combine MaxMind minFraud with Runbear's AI agent platform. By embedding AI agents into Slack or Microsoft Teams, you empower every team member to access, understand, and act on MaxMind minFraud insights—without ever leaving your main communication tool.

About MaxMind minFraud

MaxMind minFraud is a cloud-based API that helps businesses detect and prevent online payment fraud in real time. It analyzes transaction details and customer data—like IP addresses, payment cards, emails, and more—to deliver an actionable risk score and over 80 fraud signals. Large e-commerce, SaaS, financial, and marketplace teams use MaxMind minFraud to cut down on chargebacks, automate manual reviews, and minimize fraud losses. The service aggregates intelligence from thousands of global businesses, providing constantly updated models and datasets tailored to digital transactions. Teams rely on minFraud to power decisioning engines and to rapidly respond to emerging threats while maintaining a good user experience for genuine customers—making it the industry standard for online fraud risk assessment.

Use Cases in Practice

Let’s dig into how teams can bring MaxMind minFraud’s fraud prevention capabilities right into the flow of daily work using Runbear’s AI agent. Imagine your finance, risk, and support teams collaborating in Slack: the AI agent can post scheduled risk summary reports using MaxMind minFraud data each morning, let users instantly ask about the risk score for a specific order, or fetch underlying data points with a simple natural question. By syncing your fraud policies and MaxMind minFraud documentation, the AI agent can field questions like 'What triggers a manual review?' or 'Who reviews high-risk transactions?', freeing up senior analysts’ time and speeding up onboarding for new team members. During investigations, AI agents surface relevant minFraud records and help coordinate next steps—with all intelligence and action in a single, searchable place. This is similar in spirit to our AI-Powered Executive Dashboard, where live analytics and insights are made instantly available to leaders, or our Simplify Your Business Analytics guide, which shows how AI agents make business-critical data accessible across teams.

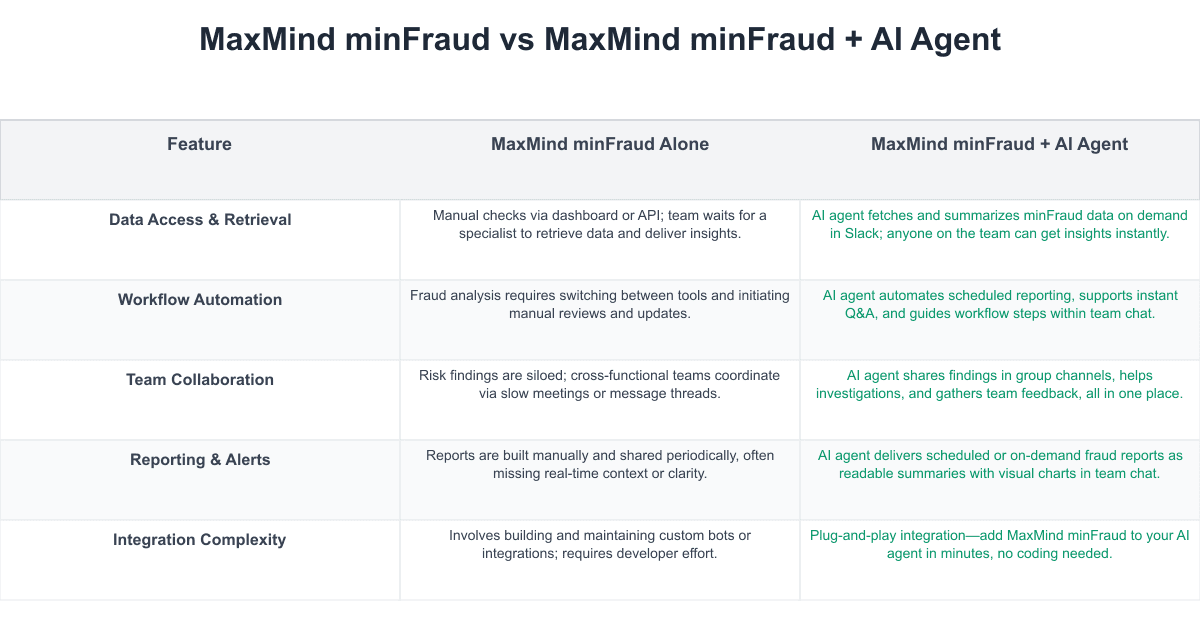

MaxMind minFraud vs MaxMind minFraud + AI Agent: Key Differences

Integrating MaxMind minFraud with Runbear transforms your fraud management from isolated, manual checks to seamless, AI-powered collaboration. Instead of toggling between dashboards and emails, AI agents bring fraud intelligence straight into team conversations, automate complex queries, and help teams respond faster with shared context. Here’s how the experience changes:

Implementation Considerations

When adding MaxMind minFraud workflows to your team's toolkit, careful planning is key. First, integration setup can be a barrier if you rely solely on developer resources or custom scripts; Runbear’s plug-and-play integration minimizes this effort. Teams need to train members not only on fraud concepts but on how to access and interpret minFraud data—the AI agent’s natural language interface dramatically reduces this learning curve. Change management is essential: moving fraud intelligence into shared channels can drive culture shift, so updating documentation, permissions, and review processes is a must. You’ll need to grant the right API and data access, review security controls, and ensure compliance with privacy and regulatory standards. Continuous monitoring and regular feedback cycles—supported by the AI agent—help refine these new workflows for maximum impact. For more on best practices for AI deployment across teams, see our AI Assistants Use Cases handbook.

Get Started Today

Integrating MaxMind minFraud with Runbear enables every team to act on fraud risks faster, smarter, and together. AI agents turn siloed insights into collaborative, automated team workflows—reducing overhead and improving decision-making. As with all workflow shifts, start small, iterate on your team's needs, and let user feedback guide your rollout. Ready to bring MaxMind minFraud’s intelligence into your team chat? Try the Runbear integration today and see how seamless, AI-powered fraud management can level up your team's collaboration and effectiveness.